The importance of valuing latent orders to successful Amazon Sponsored Products management

Sponsored Products is the most widely adopted Amazon search ad format, and typically accounts for more than six times as much ad spend as Sponsored Brands ads for the average Tinuiti (my employer) advertiser. As such, it’s incredibly important for advertisers to understand the full value that these ads drive.

Part of this is understanding the click-to-order period between when a user clicks on an ad and when that user ends up converting. Given how Amazon attributes orders and sales, it’s crucial that advertisers have an idea of how quickly users convert in order to value traffic effectively in real time.

Amazon attributes conversions and sales to the date of the last ad click

When assessing performance reports for Sponsored Products, advertisers should know that the orders and sales attributed to a particular day are those that are tied to an ad click that happened on that day. This is to say, the orders and sales reported are not just those that occurred on a particular day.

Advertisers viewing Sponsored Products conversions and sales in the UI are limited to only seeing those orders and sales attributed to the seven days following an ad click. However, marketers pulling performance through the API have greater flexibility and can choose different conversion windows from one to thirty days, which is how the data included in this post was assembled.

In the case of Sponsored Display and Sponsored Brands campaigns, performance can only be viewed using a 14-day conversion window, regardless of whether it is being viewed through the UI or through an API connection.

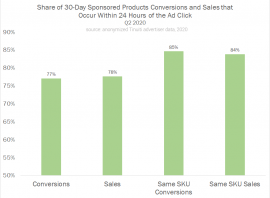

For marketers who wish to use a thirty-day conversion window in measuring Sponsored Products sales and conversions attributed to advertising, this means that it would take thirty days after the day in question in order to get a full picture of all conversions. Taking a look across Tinuiti advertisers, the first 24 hours after an ad click accounted for 77% of conversions and 78% of sales of all those that occurred within 30 days of the ad click in Q2 2020.

Unsurprisingly, the share of same-SKU conversions that happen in the first 24 hours is even higher, as shoppers are more likely to consider other products the further removed they become from an ad click.

For the average Amazon advertiser, we find that more than 20% of the value that might be attributed to ads happens more than one day after the ad click, meaning advertisers must bake the expected value of latent orders and sales into evaluating the most recent campaign performance. The math of what that latent value looks like varies from advertiser to advertiser.

Factors like price impact the length of consideration cycles

The time it takes for consumers to consider a purchase is naturally tied to the type of product being considered, and price is a huge factor. Taking a look at the share of 30-day conversions that occur more than one day after the click by the average order value (AOV) of the advertiser, this share goes up as AOV goes up. Advertisers with AOV over $50 saw 25% of orders occur more than 24 hours after the ad click in Q2 2020, whereas advertisers with AOV less than $50 saw 22% of orders occur more than 24 hours after the ad click.

Put simply, consumers usually take longer to consider pricier products before purchasing than they take to consider cheaper products, generally speaking. Other factors can also affect how long the average click-to-order cycle is for a particular advertiser.

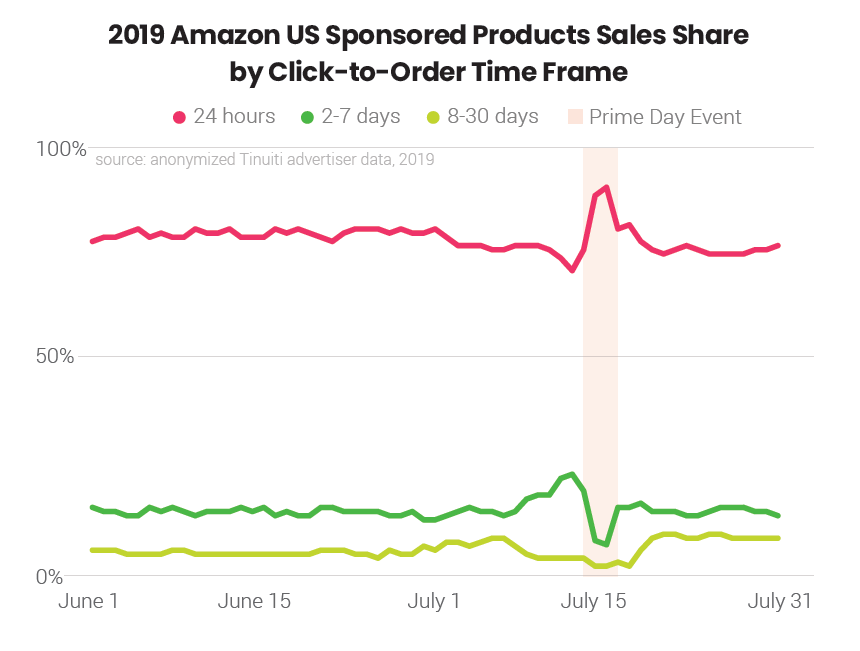

In addition to latent order value varying by advertiser, there can also be meaningful swings in what latent order value looks like during seasonal shifts in consumer behavior, such as during the winter holiday season and around Prime Day.

Key shopping days speed up conversion process

The chart below depicts the daily share of all conversions attributed within seven days of an ad click that occurred during the first 24 hours. As you can see, one-day order share rose significantly on Black Friday and Cyber Monday as users launched into holiday shopping (and dropped in the days leading into Black Friday).

After these key days, one-day share returned to normal levels before rising in the weeks leading up to Christmas Day before peaking on December 21 at a level surpassing even what was observed on Cyber Monday. December 21 the last day many shoppers could feel confident in placing an order in time to receive it for the Christmas holiday, and it showed in how quickly the click-to-purchase path was for many advertisers.

Of course, Amazon created its own July version of Cyber Monday in the form of Prime Day, and we see a similar trend around one-day conversion share around the summer event as well.

This year’s Prime Day has been postponed, but reports indicate that the new event might take place in October.

As we head into Q4, advertisers should look at how the click-to-order window shifts throughout key times of the year in order to identify periods in which latent order value might meaningfully differ from the average.

Conclusion

Like any platform, advertisers are often interested in recent performance for Amazon Ads to understand how profitable specific days are. This is certainly important in determining shifts and situations in which budgets should be rearranged or optimization efforts undertaken, and that’s even more true now given how quickly performance and life are changing for many advertisers as well as the population at large.

However, in order to do so effectively, advertisers must take into consideration the lag that often occurs between ad click and conversion. Even for a platform widely regarded as the final stop for shoppers such as Amazon, more than 20% of 30-day conversions occur after the first 24 hours of the click, and this share can be much higher for advertisers that sell products with longer consideration cycles.

Further, advertisers should look to historic performance around key days like Cyber Monday and Prime Day to understand how these estimates might shift. Depending on product category, other holidays like Valentine’s Day or Mother’s Day might also cause shifts in latent order value.

Not all advertisers necessarily want to value all orders attributed to an ad over a month-long (or even week-long) attribution window equally, and particularly for products with very quick purchase cycles, it might make sense to use a shorter window. That said, many advertisers do find incremental value from orders that occur days or weeks removed from ad clicks, and putting thought into how these sales should be valued will help ensure your Amazon program is being optimized using the most meaningful performance metrics.

The post The importance of valuing latent orders to successful Amazon Sponsored Products management appeared first on Marketing Land.

From our sponsors: The importance of valuing latent orders to successful Amazon Sponsored Products management