The importance of building brand awareness through Amazon advertising

In the early goings of Amazon’s advertising platform, most advertisers looked to it as another source of ad inventory that should be focused on direct response. This is in large part due to Sponsored Products typically being the first format brands wade into, and that format produced a whopping 13% conversion rate for the median advertiser under Tinuiti (my employer) management in Q4 2019. As such, it’s safe to say that Amazon ads are certainly a strong avenue for driving orders and sales.

However, it’s no longer the case that Amazon advertisers are focused entirely on direct response goals, and marketers should be looking at the brand-building potential across both display and search ads in order to get the most out of the platform.

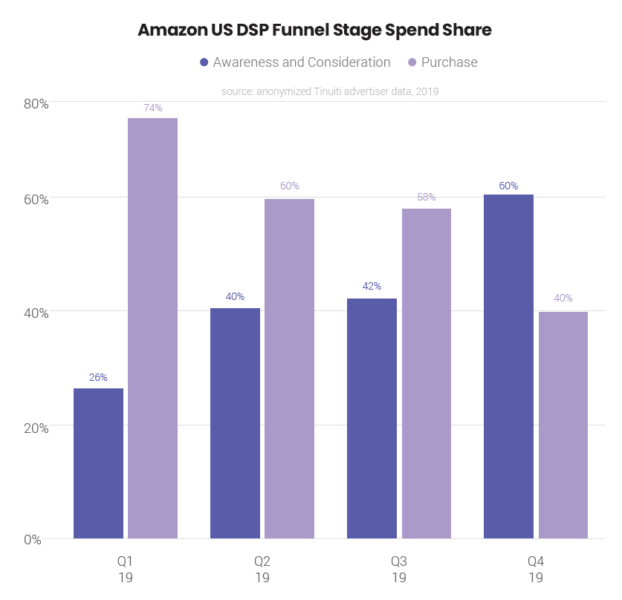

Amazon DSP advertisers increasingly focused on awareness and consideration

The Amazon Demand-side Platform (DSP) allows marketers to target display inventory both on and off Amazon. Across a sample of dozens of Amazon DSP advertisers, we found that the share of spend allocated to campaigns focused on building awareness and consideration grew from 26% in Q1 2019 to 60% in Q4.

As you can see from the chart above, advertisers began 2019 allocating nearly three quarters of all DSP spend to purchase-focused campaigns, but that share slipped to 40% by the end of the year. This increased willingness to invest in campaigns focused on more upper-funnel goals has enabled marketers to rapidly expand investment in the platform, and in Q4 ad spend grew 44% relative to Q3, the largest quarter-over-quarter growth of the year.

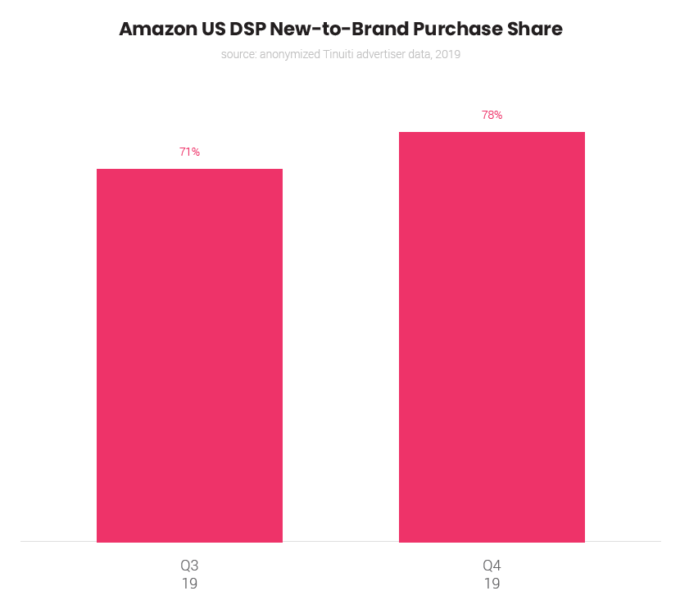

Investing in brand awareness campaigns also has the trickle-down effect of producing more customers that have not purchased from the brand previously or who are infrequent purchasers. Looking at new-to-brand metrics, which identify those customers which have not purchased from a brand on Amazon in the last twelve months, the share of total DSP purchases attributed as new to the brand advertising went from 71% in Q3 to 78% in Q4.

While some of this increase may be tied to seasonal shifts, it certainly makes logical sense that investing in campaigns aimed at building brand awareness would in turn spur on more new customers to purchase from a brand.

Much like any DSP, advertisers have the ability to choose different ad formats and dimensions to create different experiences. While advertisers generally use Dynamic Ecommerce Ads for use in purchase-focused campaigns, static banners give marketers the ability to inject brand and lifestyle images into the creative used for those campaigns that are more focused on building the brand.

Looking outside of the Amazon DSP, advertisers are also finding success in building brand awareness through the Sponsored Brands format.

Sponsored Brands new-to-brand share rises in Q4

New-to-brand metrics are also available for the Amazon Sponsored Brands ad format, which appears at the top of Amazon search results as well as additional placements rolled out in late 2018. Tinuiti advertisers saw the share of total Sponsored Brands conversions attributed as new-to-brand grow from 58% in Q3 to 60% in Q4.

Even more interesting is how new-to-brand share moved during the core weeks of the winter holiday shopping season between Thanksgiving and Christmas Day. During this roughly four-week period, daily new-to-brand conversion share averaged 64%, compared to the 60% figure observed for Q4 overall.

As such, it seems that customers are more willing to purchase from brands they haven’t bought from previously and/or those which they haven’t purchased from in at least a year during the holidays. This is an important consideration to keep in mind when allocating budget and placing bids throughout the crucial holiday shopping season.

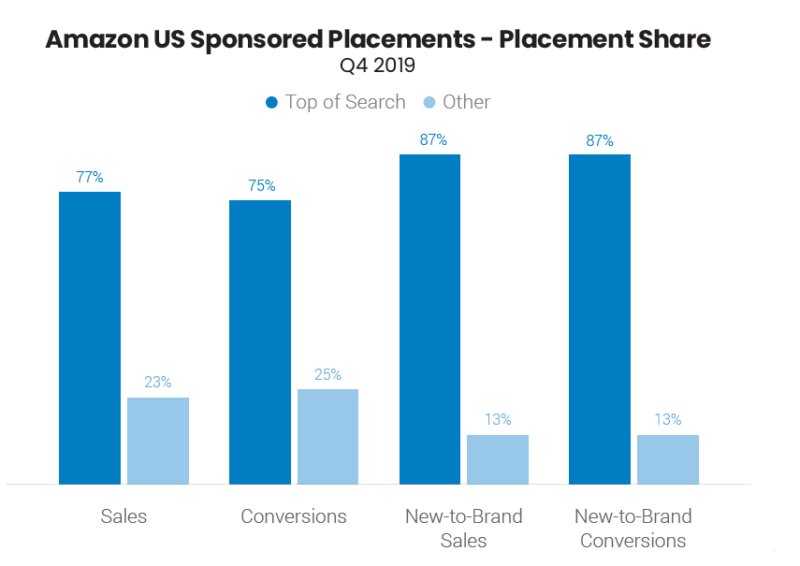

As mentioned previously, these ads show at the top of search results as well as some other placements along the right rail, at the bottom of desktop results, and intermittently throughout mobile results. Taking a look at the share of conversions that placements at the top of search results account for, these slots produced 75% of all conversions in Q4 2019. Even more impressive, however, is that they produced 87% of all new-to-brand conversions.

Knowing this, brands looking to reach new customers should pay extra close attention to where their ads are showing on the page and adjust bids to ensure ads are reaching the competitive top of page placements.

Conclusion

What was once an opportunity that most advertisers used primarily for direct response, purchase-focused goals has quickly evolved over the last year. Marketers that are able to take advantage of the brand-building potential of both Amazon search and display formats and bake the expected value of these tactics into budget and bid planning will be able to maximize their output from Amazon advertising. Those that don’t will have a harder time competing moving forward.

Join us for two days packed with expert insights and tactics on all things digital commerce marketing — from Amazon to Google to Instagram and more — at SMX West in San Jose this month. > (opens in a new tab)”>Check out the agenda >>

The post The importance of building brand awareness through Amazon advertising appeared first on Marketing Land.

From our sponsors: The importance of building brand awareness through Amazon advertising