Moving from vendor to seller on Amazon? Here’s what you need to know

Amazon always takes the long view. Though it’s hard to imagine Amazon’s domination of e-commerce changing any time soon, the retailer has set its sights on also challenging the giants of brick-and-mortar including Walmart, Costco and Target.

To that end, Amazon is poised to implement a long-rumored change to force smaller vendors (less than $10M per year) to move from Vendor Central to Seller Central. Last week, Bloomberg reported that Amazon is planning a “large scale reduction” of small vendors in order to cut costs, increase automation, and prioritize its partnerships with major brands.

Though they have not yet announced an official policy to this effect, their actions speak louder than words. In March, Amazon unceremoniously paused its weekly replenishment orders for over ten thousand small vendors below the $10M per year mark. Shortly afterward, Amazon claimed that many of these interruptions were done in error. Most (but not all) of the vendors had their orders resumed, but with a catch – they were required to register with Amazon’s Brand Registry or, failing to register, move from Vendor to Seller Central.

If you’re among the tens of thousands being forced to make the change, you need to understand the implications of this change in order to properly adapt and prepare yourself for a smooth transition.

What is Seller Central?

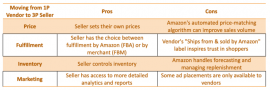

Amazon is really two different marketplaces stacked on top of each other. The first party (1P) marketplace is where Amazon sells inventory directly, buying stock in bulk from 1P vendors and then pricing and selling those products to consumers. 1P suppliers use Vendor Central (VC) to control their product detail pages and manage purchase orders. In the third party (3P) marketplace, instead of selling wholesale to Amazon the merchant uses Amazon as a platform to sell directly to consumers and pays a commission. These sellers manage their product offerings using Seller Central (SC).

The 3P marketplace has grown more rapidly than 1P and now accounts for roughly two thirds of sales, leaving plenty of opportunity for those making the switch.

Though this transition may prove to be a challenge, many vendors have willingly made the move, preferring the advantages of SC over VC. “It’s a whole new way of selling for most firms, but in most cases, a motivated company can be up and running in the marketplace in just a few months,” said Allan Peretz, President of Bold Retail, Inc.

The impact on advertising

Perhaps the biggest downside of Seller Central is the advertising limitations. 1P vendors have access to three main types of ads: Sponsored Product, Sponsored Brand and Product Display. Out of the box, Seller Central only gives access to sponsored product ads. 3P sellers can only access sponsored brand placements if they are registered with Amazon’s Brand Registry, which requires holding a trademark for the product. Product display placements are not available in SC at all.

Product display ads, which appear on the right side of a product detail page (PDP) below the buy box, serve several strategic functions. They can be used by vendors to advertise on their own PDPs in order to prevent competitors from gaining visibility there, to generate brand awareness by targeting shoppers by category or interest, and to upsell or cross-sell (for instance, by placing a roduct display ad for a brand’s bestselling product on all other PDPs). Losing access to these ads while moving from vendor to seller is a major downside.

Many sellers will also see a decrease in ad performance. Amazon’s advertising algorithms leverage historical campaign performance data for relevancy and moving from vendor to seller often means starting over from scratch. Without historical data, a new Seller Central campaign, even if it’s otherwise identical to a previous Vendor Central campaign, will take time to regain the lost momentum.

The transition will be rocky, but it’s not all doom and gloom. In recent years Amazon has been improving SC to have much of the same functionality as VC, so it’s likely that at some point Amazon will introduce product display ads for sellers. In the meantime, the ability for sellers to directly manage product pricing gives them more strategic control, allowing them to execute marketing campaigns without the risk of lost profit margins or inter-channel conflicts.

How to make a smooth transition

Transitioning from a wholesale supplier to a marketplace seller can take several months. With the mounting evidence that Amazon is indeed planning to reduce smaller vendors in favor of taking their “hands off the wheel” and reducing direct human intervention in their retail business, it’s a good idea for vendors to have a backup plan in place.

“They will have to learn how to directly manage pricing and promotion, collect sales tax, deal with customer questions and complaints online, handle returns and make significant changes to how they manage and track inventory,” said Peretz. “Most companies will benefit from a little help on the front-end to develop a custom approach that fits with their existing processes, systems and organization.”

The post Moving from vendor to seller on Amazon? Here’s what you need to know appeared first on Marketing Land.

From our sponsors: Moving from vendor to seller on Amazon? Here’s what you need to know