Have we hit bottom yet? What new earnings reports say about COVID’s impact on digital advertising

“We experienced a significant reduction in the demand for advertising, as well as a related decline in the pricing of our ads, over the last three weeks of the first quarter of 2020.” — Facebook (Advertising revenues increased by 17% year-over-year to $17.4 billion.)

“. . . but then in March we experienced a significant slowdown in ad revenues” — Google/Alphabet (Advertising revenues increased by 10% year-over-year to $33.8 billion for the quarter.)

“. . . a strong start to the quarter that was impacted by widespread economic disruption related to COVID-19 in March.” — Twitter (Ad revenue was flat year-over-year at $682 million.)

“While many advertising budgets declined due to COVID-19, we experienced high revenue growth rates in the first two months of the quarter which offset our lower growth in March.” — Snap (Revenue increased by 44% year-over-year to $462 million.)

“. . . a significant reduction in advertising spend, which impacted our Search and LinkedIn businesses.” — Microsoft (Search ad revenue grew by 1% and LinkedIn revenues increased by 21%.)

The statements above come from each company’s formal quarterly press releases or earnings calls for the period ending March 31, 2020. They reflect the sudden impact of COVID-19 on their ad businesses in the final weeks of the quarter, dulling what had been a strong start to the year.

Direct response was a buffer

With the feast or famine nature of this crisis, many companies saw demand skyrocket and those that continued to see ROI from their performance campaigns held the course or increased ad spend on certain channels. Facebook, Google and Snap mentioned the positive impact of direct response revenue at the end of the quarter.

Facebook CFO David Wehner said performance advertisers that “get those results that they’re looking for” kept spending, while those “looking for offline or more top of funnel brand, there we’ve seen more pullback in spend.”

YouTube has been making in-roads in direct response, but it has long been courting brand advertisers and their TV budgets. Last quarter, it was performance campaigns that held strong while companies pulled back on their branding campaigns.

“Direct response continued to have substantial year-on-year growth throughout the entire quarter,” Ruth Porat, Google and Alphabet CFO said about YouTube. “Brand advertising growth accelerated in the first two months of the quarter, but began to experience a headwind in mid-March.” That caused YouTube’s year-on-year ad revenue growth to slow to “high single digits.”

CEO Sundar Pichai called out app installs and gaming as areas where YouTube has gained traction in direct response.

Snap, which reported strong quarterly revenue growth at 44% year-over-year, said its direct response revenue has doubled as a share of the company’s total ad revenue in the past two years. “Consequently, this strategy has put us in strong position for this immediate crisis as well as continue to take share of the digital ad market on the road to recovery,” said Snap’s Chief Business Officer Jeremi Gorman said on the earnings call.

A sense of what’s to come

Due to the volatility of the situation, many companies declined to provide financial guidance for the second quarter of 2020. However, based on several statements, April appears to be shaping up to be, well, like March — meaning things may not be improving much but that we may have hit bottom.

Google’s Ruth Porat said in the first few weeks of April that Search had not seen further percentage declines in year-over-year revenue from the end of March and that YouTube’s direct response ad revenue remained strong. But she noted that “we have seen continued decline in Brand advertising.”

Likewise, Facebook said it has seen “signs of stability” in the first three weeks of April. The company said ad revenue has been roughly flat compared to the same period a year ago and down from the 17% year-over-year growth in the first quarter of 2020. “The April trends reflect weakness across all of our user geographies as most of our major countries have had some sort of shelter-in-place guidelines in effect,” the company said.

Microsoft said that it expects the significantly lower ad spend levels seen in March will continue in this quarter, “which will impact Search and LinkedIn.”

Media buyer sentiment, creative plans

In its most recent survey of media buyers, released Thursday, the IAB asked about advertising spending plans for March through June. There was a bit of improvement in digital spend expectations compared to the last survey in March, but they remain below plan.

In the IAB’s March survey, buyers said they expected digital ad budgets to be cut by 33% on average in the second quarter, whereas the April survey showed a slight bump to an average cut of 29%. In contrast, traditional media spend projections for the second quarter fell from expected cuts of 39% on average in March to 44% in April.

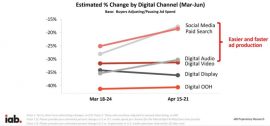

Search and social appear best positioned for a rebound. These budgets are still below plan, but the planned cuts for the quarter have shrunk considerably in the period between the two surveys, as shown in the chart below.

Looking at targeting and buying tactics, the IAB found an increased interest in national and local geotargeting as well as in direct buys with premium publishers. The interest in geo-targeting makes sense as the impact of the virus and shelter in place policies vary.

In contrast, there was a decline in interest for demographic and audience targeting buys between March and April. This may be a reflection of the dramatic shifts in consumer behavior have rendered existing audiences less effective.

Regardless of spending changes, 73% of advertisers said they are modifying or developing new creative assets. Of those who are updating creative, 58% said they plan to mention coronavirus, COVID-19, or in some way reflect the crisis in their ads. Certainly, advertisers don’t want to be tone-deaf, but it begs the question of whether consumers will become corona-weary or even corona-blind to an inundation of ads talking about “these uncertain times.”

More about marketing in the time of the coronavirus

This story first appeared on Search Engine Land.

The post Have we hit bottom yet? What new earnings reports say about COVID’s impact on digital advertising appeared first on Marketing Land.

From our sponsors: Have we hit bottom yet? What new earnings reports say about COVID’s impact on digital advertising