Breaking down silos in e-commerce retail

In general, e-commerce retail can be thought of in three main parts: customer acquisition, conversion and retention/measurement.

- Customer acquisition is what the majority of digital marketers are concerned with. It’s all the different product advertising efforts across all digital channels that lead a customer to discover your products.

- Conversion is about getting the customer to make a purchase. To a certain extent, this is about the experience your website presents a customer, but mostly it’s about whether you have the product the customer wants to buy and are you selling it at a price they are willing to pay. Conversion, therefore, has a lot to do with your price and inventory management.

- Retention and measurement are about how much each new customer is worth to your business — i.e., how many purchases are they likely to make. This means integrating your CRM (Customer Relationship Management) and ERP (Enterprise Resource Planning) systems to make sure you are getting the maximum profit from your customers for your advertising spend.

Each of these three pieces of the tripod is equally important in order to have a successful business, and each one collects an incredible amount of data. Unfortunately, in the majority of companies, that data remains siloed within the team that collected it. Data is not being fed back into other parts of the marketing machine; as a result, revenue is being lost and ad spend is wasted.

I believe that in order to create a truly optimized marketing process, retailers need to integrate their product advertising efforts with inventory management and price competitiveness.

Let’s look at what can be achieved by breaking down these marketing silos.

Product advertising and price management

I’ve talked before about how if you fail at pricing, you’ll fail at product advertising. What this means is that Google (and other PLA networks) include price competitiveness as an algorithmic signal. According to our research, lower-priced products generate 4x more conversions than expensive products.

If your product’s price is above the average, it’s virtually impossible for you to reach position one, no matter how high you raise your CPC (cost per click) bid. Therefore, bidding higher (or at all in some cases) on products that are not priced competitively is a complete waste of money.

The key takeaway here is to not waste your advertising budget bidding aggressively on overpriced products. Instead, use product advertising performance as a way to test the price elasticity of your products. Play around with raising and lowering prices to find out where the optimum conversion level is.

Even if you can’t change your products, you should at the very least be using pricing data to inform your product advertising strategy. Focus your ad spend on those products that are competitively priced, and use them as a gateway to your website.

Product advertising and inventory management

Data silos and misaligned metrics between the advertising and merchandising departments can cause retailers to waste significant amounts of money.

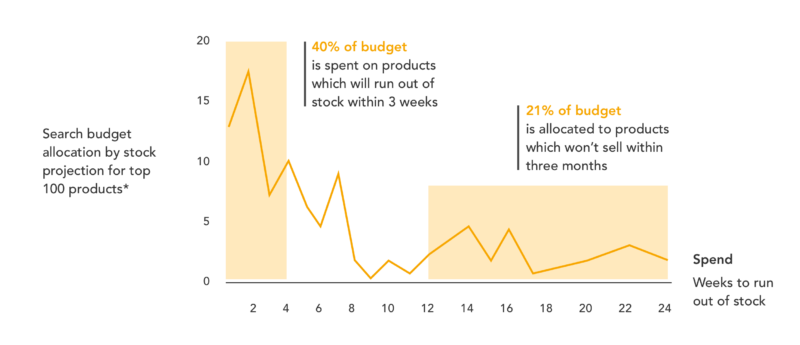

In many organizations, excess budget is allocated to products that quickly run out of stock, rather than products that really need an advertising push to sell out. In fact, according to our research, around 40 percent of ad budgets are spent on products that will run out of stock within three weeks. On the flip side, only 21 percent of budgets are allocated to products that won’t sell out within three months.

The way I see it, there’s no sense in wasting money on products which will run out of stock anyway. Instead, PLA (product listing ads) budgets should be used to add market pressure to slow-moving stock that would benefit from additional support.

Using feed advertising systems and an advanced product advertising tool, you can use inventory to direct product ad investment based on your sell-through rate and stock level.

Product advertising and CRM/ERP

One reason too much ad spend is going toward products which would sell anyway is that digital marketers are focused on improving ROAS (return on ad spend). This ROAS model of measuring search marketing simply doesn’t work.

[Read the full article on Search Engine Land.]

From our sponsors: Breaking down silos in e-commerce retail