Amazon advertising growth slowed again in Q1: Does it matter?

Data source: Amazon

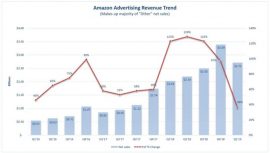

For a few quarters there, Amazon was posting triple digit growth rates. Then growth slowed to 97% in the fourth quarter of 2018 and Thursday, the company reported just 36% growth in its advertising business line for the first quarter of 2019.

Amazon reports advertising business under an “Other” category. And while advertising accounts for the majority of that category, Amazon said that the advertising business actually grew “a bit more” than 36% in the first quarter. Another thing to note is an accounting change puts previous quarters in a more favorable light, so the actual separation isn’t as big as it looks. All that said, Amazon is clearly invested in growing its advertising and it still very early days for that piece of the business. Here is what Amazon had to say about it on Thursday’s earning call.

Focus on ad relevancy. “I would say really what we’re focused on right now is driving relevancy, ensuring that we service the most useful ad as possible. I think that’s going to be the best experience for customers and also for advertisers.” Brian Olsavsky, Amazon’s CFO, said on the earnings call when asked about the deceleration over the past two quarters.

Building tools to make buying easier. “So most of our focus has been on again adding more functionality, adding more products and adding — reporting for businesses and advertisers — so they can understand the incremental customers they’re seeing on Amazon through advertising with Amazon,” said Olsavsky. “So it’s more right now about tools and making better recommendations, making it easier to use our Amazon demand-side platform, things like that, operational improvements.”

Support for brands. “And then, I guess, we’re very focused on serving brands as well. That’s another theme that we have,” Olsavsky said. “These brand stores that we have are easy to create, customize, and we’ve had great pickup on that from brands, but they can show shoppers who they are and tell their story. So it builds a better engagement for the brand and the customer. It builds better customer loyalty both to that brand and also to Amazon.”

Still a nascent business. “I would just say, we’re early on in this venture. There’s a lot of — it’s having a lot of pickup by both vendors, sellers and also authors. So again, we feel like if we work on the inputs on this business and continue to grow traffic to the site, we will have a good outcome in the advertising space.”

Why we should care. So is this deceleration just reflection of growing pains? It’s likely we’ll continue to see growth ebb and flow as Amazon continues to invest in the platform and products. Amazon has made several changes that reflect the goal of improving “efficiency and also performance of the advertisement themselves” that Olsavsky noted. In September, it streamlined its ad products in an effort to simplify ad buying in the vein of Google and Facebook’s ad platforms New display and video formats, more inventory for Sponsored Products and Sponsored Brands ads.

Among its clients, Merkle reported that Amazon advertisers saw sales attributed to both Sponsored Brands more than double year over year, as spend grew 19% and 77% for those formats respectively. More than half of spend on the Sponsored Products came from placements other than the top-of-search results, said Merkle.

Speaking of investments, Amazon also dropped the news that it is investing $800 million to default to one-day shipping for Prime members, instead of the current two-day shipping offer.

The post Amazon advertising growth slowed again in Q1: Does it matter? appeared first on Marketing Land.

From our sponsors: Amazon advertising growth slowed again in Q1: Does it matter?