Smart speakers, smartphone shipments heading in opposite directions

According to analyst firm Canalys, global smart speaker shipments grew 131% year over year. China is now the fastest-growing smart speaker market in the world, overtaking the U.S. in the first quarter of 2019. Smartphone growth by comparison, declined by 18% in the North American market.

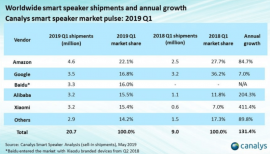

Amazon grows its overall lead, China accelerates. Amazon remained the smart speaker leader with 22% of global first-quarter shipments, while Google was second with 17%. What’s significant however is the growth gap between Amazon and Google. The former saw 85% annual shipments growth; Google saw only 7 percent growth. Google Home had lead Amazon in the first quarter of 2018. That trend was more than reversed in the first quarter of 2019, according to Canalys estimates.

Following Amazon and Google were the Chinese device makers, which collectively saw massive growth and helped push smart speaker shipments in that country to 51% of the global total, according to Canalys.

Smartphone shipments in ‘freefall.’ In contrast to the still relatively young smart speaker/display market, the North American smartphone market is mature at almost 12 years old — if we date it from the launch of the first iPhone in 2007. It’s several years older if we include earlier Windows Mobile, BlackBerries and Palm devices.

According to the International Telecommunications Union, there are now more active mobile phone subscriptions than humans on planet earth. This is a function of multiple active subscriptions per person, given that more than 1 billion people still don’t have mobile phones. Other mobile phone penetration estimates are lower.

Q1 2019 smartphone shipments (North America)

Previously Canalys characterized the global smartphone market as in “freefall” and said the first quarter of 2019 was the “sixth consecutive quarter of decline” in new devices shipped. Shipments are not identical to sales but directionally consistent with them.

Why we should care. Mobile devices and associated consumer behaviors have driven digital ad-spending growth for Google and Facebook for many quarters. Market saturation and a stabilizing of mobile consumer activity suggest that mobile ad revenues in the U.S. may slow in the coming quarters.

Conversely, a clear marketing/ad model for smart speakers and displays has not yet emerged though Google is starting to monetize its Home/Nest devices with some ads (via Google Music) and transactional revenues. The jury is still out on how valuable a promotional channel smart speakers and displays will become.

The post Smart speakers, smartphone shipments heading in opposite directions appeared first on Marketing Land.

From our sponsors: Smart speakers, smartphone shipments heading in opposite directions